DraftKings Executives Sell $206M Worth of Company Stock in 2024

DraftKings insider stock sales reached nearly $206 million in 2024, raising concerns among investors as the company's stock performance lagged behind major market indices. The gaming company's shares rose only 5.53% during the year, significantly underperforming compared to the Nasdaq 100, S&P 500, and key competitors.

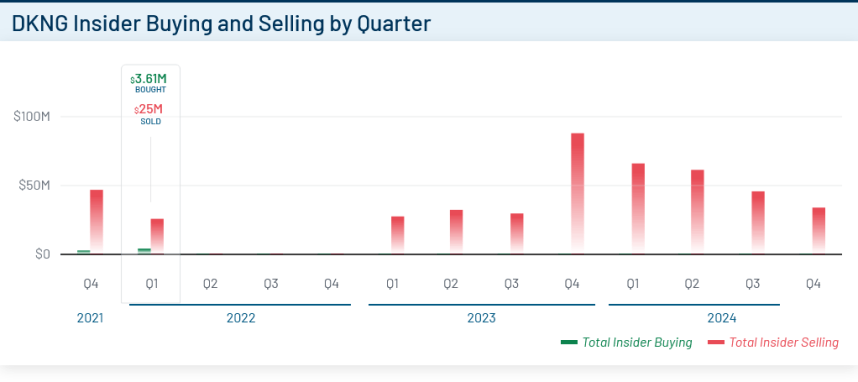

Key highlights of DraftKings insider trading in 2024:

- Total insider sales: $205.54 million

- Zero insider purchases recorded

- Quarterly sales declined throughout the year:

- Q1: $66 million

- Q2: $61 million

- Q3: $45 million

- Q4: $34 million

DKNG insider trading activity chart

The pattern contrasts sharply with competitors:

- Flutter Entertainment (FanDuel parent) showed no insider sales in Q4 and announced a $5 billion share repurchase program

- Caesars Entertainment reported less than $350,000 in insider sales

- Penn Entertainment saw insider purchases of $2.61 million versus sales of only $126,578

DraftKings' stock performance also fell behind competitors, with Flutter Entertainment gaining 44.39% in 2024. Notable sellers included Chief Legal Officer R. Stanton Dodge and co-founder Paul Liberman, who collectively sold over $30 million in December alone.

The consistent insider selling pattern, combined with the absence of insider purchases and underperforming stock returns, has sparked concerns among retail investors about executive confidence in the company's future prospects.

Related Articles

Royal Reels Casino: A 2023 Online Gaming Rising Star